-

-

Q Mastercard

-

Q Card

-

Login

This time of year, is the perfect time to review your personal finances to ensure you’re fighting fit – financially.

That’s where a balance transfer can be really beneficial.

For a limited time we’re offering 1.99% p.a. interest for 18 months on eligible balances transferred* to a Q Mastercard.

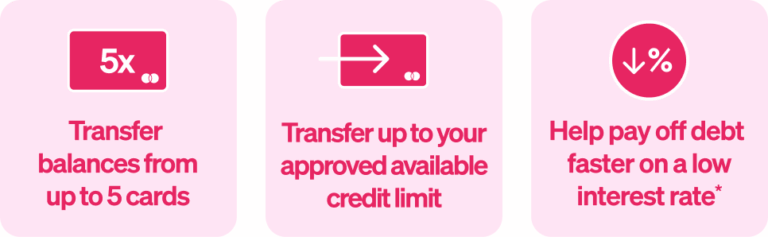

Apply for a Q Mastercard between 13 January – 22 March 2026 using promo code SWITCH2Q and if approved you can transfer balances from up to 5 credit cards.

There is a minimum balance transfer amount of $500 per card. See full details below.

A balance transfer is where you can transfer an outstanding balance from another eligible credit card to your Q Mastercard account to pay a low interest rate.

The Q Mastercard balance transfer offer* is designed to help pay less interest over 18 months so that you can work towards paying off the balance owing sooner. You can transfer from up to 5 credit cards, making it easy to consolidate and manage debt.

With a Q Mastercard balance transfer, you can transfer an amount up to your available Q Mastercard credit limit.

The balance transfer interest rate of 1.99% p.a. for 18 months only applies to the balance transferred*.

Use promo code SWITCH2Q on the first page of your application.

You must complete and submit your application before 22 March 2026 to be eligible for a balance transfer*.

If your application is approved, you will receive an email to get started on a balance transfer.

This will also be available on your My Account online.

Get started on your transfer by filling in all your transfer details.

Once completed submit the request and we will take care of the rest!

Processing the Balance Transfer request can take up to 5 business days after we receive your request.

Keep an eye on your Q Mastercard App to see when the balance transfer has been completed.

Once you have completed the balance transfer you will receive a confirmation email from Q Mastercard

The promotional interest rate of 1.99% p.a. will apply to your transferred balance for 18 months* from the date it was transferred.

Reach out to your bank or credit card issuer to settle any remaining balance and close your other cards. We are unable to do this for you.

Remember to check that all direct credits or debits have been stopped or moved to another payment option

Repayments are allocated based on card use and will be allocated towards the highest interest bearing balances first.

We apply repayments on your account in accordance with the Q Mastercard terms and conditions.

Enjoy a minimum of 3 months zero interest, zero payments^ on all purchases. Always. No minimum spend.

The universal acceptance of Mastercard means you can shop wherever, online or in-store.

Q Mastercard offers access to Long Term Finance# (LTF) deals in-store and online at thousands of participating retailers throughout New Zealand.

Terms and conditions

Lending criteria, $50 annual Account Fee, fees, Ts&Cs apply.

*1.99% p.a. interest for 18 months balance transfer terms and conditions apply.

^Lending criteria, $50 annual Account Fee, fees, Ts&Cs apply. Zero interest, zero payments for three months available on all Q Mastercard Standard Purchases (excludes Long Term Finance and Cash Advances). Standard Interest Rate, currently 28.95% p.a., applies after interest free period ends. Other interest rates and fees may apply and are subject to change, see Q Mastercard terms and conditions for full details.

#Minimum purchase and/or minimum payment amounts may be required, see offers for details. Lending criteria, $50 annual Account Fee, fees, Ts&Cs apply. $55 Establishment Fee applies to your first Long Term Finance (LTF) transaction, $35 Advance Fee applies to subsequent LTF transactions. Standard Interest Rate of 28.95% p.a. applies to outstanding balance at end of LTF interest free period. Other interest rates and fees may apply and are subject to change, see Q Mastercard terms and conditions for full details. Rates and fees subject to change.